-

Working With You.

For Your Dream.Finding Mortgages for Every Stage in Your Life!

Apply Now!

-

Working With You.

For Your Dream.Finding Mortgages for Every Stage in Your Life!

Apply Now!

Our Customers Speak for Themselves

-

My experience with Central Mortgage started with a phone call from Craig Matteocci. He simply stated that he would like to work with me and see if Central Mortgage and... read more I would be a good fit. He explained everything every step of the way and was very good at keeping me informed. I appreciate the team that worked with him and the outcome was more than I expected and it was a very favorable experience. And I must say even after closing Craig is still working on my behalf. I'm a satisfied client!!

Jacqueline Collier

October 11, 2023Craig is a pleasure to work with. I felt confidence in him from first time we spoke. He explained all to me, and answered my questions. What... read more I love most about Craig is he kept me informed, daily most of the time, through the entire process of my refinance. I will recommend Craig as an Agent to others no hesitation. I have refinanced before and Craig is the most "hands on" agent I have worked with. Donna Foltz

Donna Foltz

October 10, 2023The Dream Team did a great job for us !!! Laura H. & Hagob K. have excellent customer care & service they're always available for questions, transparent with details... read more , not to mention super personable. I would recommend Central to anyone looking to get the customer care we all deserve !! Definitely 5 star team I wish they had a few more 🌟 to give. Thanks

Rob Sweeney

October 9, 2023I give central mortgage a 10 out of 10. My guy is and always will be Sebastian Kada!! This guy is the best in the business!! He goes above and... read more beyond we have even become really good friends!! This guy and his company Central Mortgage stayed after hours and helped me close the deal in 10 days. This is unheard of in this type of business!! If anyone is looking for the best in the business Sebastian Kada is at the top of the game!! See you on the next one Sebastian!!

Randy Wells

September 21, 2023I would like to give a huge thanks to the best loan officer my wife and I have ever had the pleasure of working with. Latonya Maclin and also to... read more Shawn Jackson for helping us through this process. You guys are truly phenomenal and professional. Thank you both so very much for making this process a success.

Kennis Blackwell

September 13, 2023My experience started with a phone call regarding my inquiry to refinance after I had called my mortgage company 3 times. During this call, I was transferred to Ms. Danielle... read more Curry. From the first 5 minutes of my conversation with her, I knew I was in great hands. Danielle Curry professionalism was exceptional. She walked me through the whole process and took really good care of my family. She understood my needs and what i wanted to accomplished. She was available every day. When my appraisal came low, her and her team took care of business. I was kept on the loop at all steps of the process. We closed the loan on time and even after the closing, Danielle Curry checked on me and answered questions that I had after. Great customer service. Great people. We need more companies like this one. 5 starts doesn’t do them justice. They are the best..

Kenny Ulerio

August 24, 2023Laura is very trusted person, did an awesome job assisting throughout, Laura is prompt, friendly and consistent. Her experience and expertise in the market’s geographic area was key in... read more helping to make a swift decision, she always have a solution for any issue. laura was very involved and helpful. Laura went out of her way to make sure all was in place to ensure a smooth process . Her great attitude and dedication in serving her clients reflect great credits upon herself I would totally seek to working with her again in any of my future deals.

s

August 15, 2023My experience began with a phone call. Hunter Mullet explained things and walked me through the process. Each step was explained well . Lona was able to clear up title... read more issues resulting from a divorce, and Angelo Jarbo was able to work with me and get me refinanced despite less than spectacular credit! A great team and I am appreciative of their efforts!!

Stephen McLeod

August 10, 2023Melvin with Cental Mortgage was God sent. He was so easy to work with. He called me every single day to let me know what was going on with my... read more refinance. This was the smoothest transaction ever. I was never in the dark and everything happened the way he said it would.. I highly recommend this company

Latara Bobo

August 2, 2023 -

Melvin with Cental Mortgage was God sent. He was so easy to work with. He called me every single day to let me know what was going on with my... read more refinance. This was the smoothest transaction ever. I was never in the dark and everything happened the way he said it would.. I highly recommend this company

Latara Craddock

August 2, 2023We cannot say enough about Armando and how much we appreciate his help!! He went above and beyond to streamline our loan process, we were finished in no time. He... read more was a pleasure to work with and we look forward to working with him again in the future!

Kelli Freeman

July 29, 2023If you are looking for the BESTEST Mortgage Loan Officer, look no further than Craig Matteocci! If you call there, ask for him! He is extremely polite, professional,... read more eager to help, goes above and beyond and eases your fears. There are simply NOT enough words to describe the dedication he has towards his job and clients. He was with us 200% of the way! This man deserves a million dollar raise! Central Mortgage Funding would not be as successful as they are without him! You will not be disappointed! (His boss Doug is pretty amazing also �?)

None of

July 22, 2023Craig Matteocci was a stellar Loan Officer when buying our home. He definitely went above and beyond, when helping us with our FHA loan. He diligently pushed through the... read more bumps that came up after we got our offer accepted. His confidence made the entire family feel secure with our decisions, and Craig communicated with us every step of the way. It was a long 5-6 months of searching and Craig never once made us feel like he put us on the back burner when we couldn't get an offer accepted during that long period. This man deserves a huge bonus for all the added time he put into closing our loan.

Sean Arrant

July 22, 2023I had an exceptional experience working with loan agent Tyler West at Central Mortgage. From the moment I reached out for assistance with my mortgage, Tyler displayed unparalleled professionalism and... read more expertise. He patiently guided me through the entire process, answering all my questions with clarity and ensuring I understood every step. Tyler’s dedication and commitment to finding the best loan option for me were truly remarkable. He worked tirelessly to secure the most favorable terms and rates, always keeping my best interests in mind. Throughout the process, he maintained open communication, providing regular updates and promptly addressing any concerns that arose. I highly recommend Tyler West at Central Mortgage to anyone seeking mortgage assistance. With his expertise and friendly approach, he turned what could have been a daunting experience into a smooth and rewarding journey. Thank you, Tyler, for your outstanding service!

Brian (Basil)

July 20, 2023I highly recommend Savannah and Doug for anyone considering a mortgage refinance. Their expertise, professionalism, and exceptional customer service made the entire experience positive and rewarding. I am grateful for... read more their assistance and wouldn't hesitate to work with them again in the future.

Jerry Hexum

July 19, 2023The following is from a text message I originally sent to our agent, Savon Aziz, later the same night after Savon called us HIMSELF to let us know we had... read more been APPROVED!! You just can’t beat a PERSONAL call like THAT, instead of a call from some random company employee, someone who wasn’t PERSONALLY INVOLVED in my moms application & approval process like Savon. Then again, it’s not surprising when you consider the KIND of AGENT Savon Aziz is… He’s an agent who treats his customers like they’re HIS OWN FAMILY & FRIENDS, he is very “involved�? with his customers and he CARES! He doesn’t just spew BS at his customers… his personal CONCERN isn't fake… simply put, Savon IS the REAL DEAL! Always working SO HARD for his customers! I also included is a pic of the beautiful, laser engraved wood cutting board from Savon and Central Mortgage Funding, LLC, that we received last week. Thank you!!! Below is from my own PERSONAL text message to Savon later that same night, thanking him for taking care of my mom😊. It’s as good of a review as I could possibly leave, and i think it says it all😊… “THANK YOU SO MUCH 🤗🤗🤗!!!! Thank you for ALL you have done for my mother! For CARING about her! I was SO relieved after checking reviews on Central Mortgage Funding, LLC., where ALL of the reviews were 5 �?�?’s! *** PLEASE SEE BELOW to CONTINUE reading the TEXT MESSAGE… *** So, from the MANY excellent reviews on Google AND The Better Business Bureau, to OUR own personal experience with Central Mortgage Funding, LLC and our agent Savon Aziz, I can wholeheartedly and IN GOOD FAITH, recommend Central Mortgage Funding, LLC, where you will get an agent who CARES and who goes the extra mile for YOU!!! Thank you again, Savon! You went from an agent, to a TRUSTED family friend! We both recommend you and CMF, LLC, to everyone! *** Except for the IGNORANT & USELESS reviews regarding “robo calls�? instead of being about actual customer experiences regarding the company/ agents) mostly though, the reviews were for the AGENTS 😊😊and about how the agents TRULY CARE about their customers, etc! Our experience with YOU, Savon, has only proved those ACTUAL CUSTOMER reviews correct, tenfold 🥰. “ ***

Tina Hall

July 19, 2023

Mortgage Solutions

We offer you 4 main solutions to get you into the home of your dreams! We can support refinances, conventional, FHA, VA and Jumbo loans!

One of the most common loans is the Conventional Loan. This loan commonly comes with a fixed-rate which means the interest rate will not change for the life of your loan.

This loan may be what you’re looking for if you need more flexibility on your credit history and downpayment. FHA loans are insured and backed by the Federal Housing Administration.

A VA Loan is a distinctive loan that is backed by the United States Department of Veteran Affairs. VA loans are eligible to service members and veterans to purchase or refinance a home.

If you’re looking for a mortgage that exceeds the conventional limit of $647,200 in most areas of the country. A Jumbo loan is one way for you to buy a high-priced property or home.

The Only Mortgage Company You Need

Central Mortgage Funding, LLC is built on the relationships we make every day.

When you work with CMF you’re family, there’s no way around it. We share our customer’s vision, we work hand in hand with you through our financial products, services and so much more.

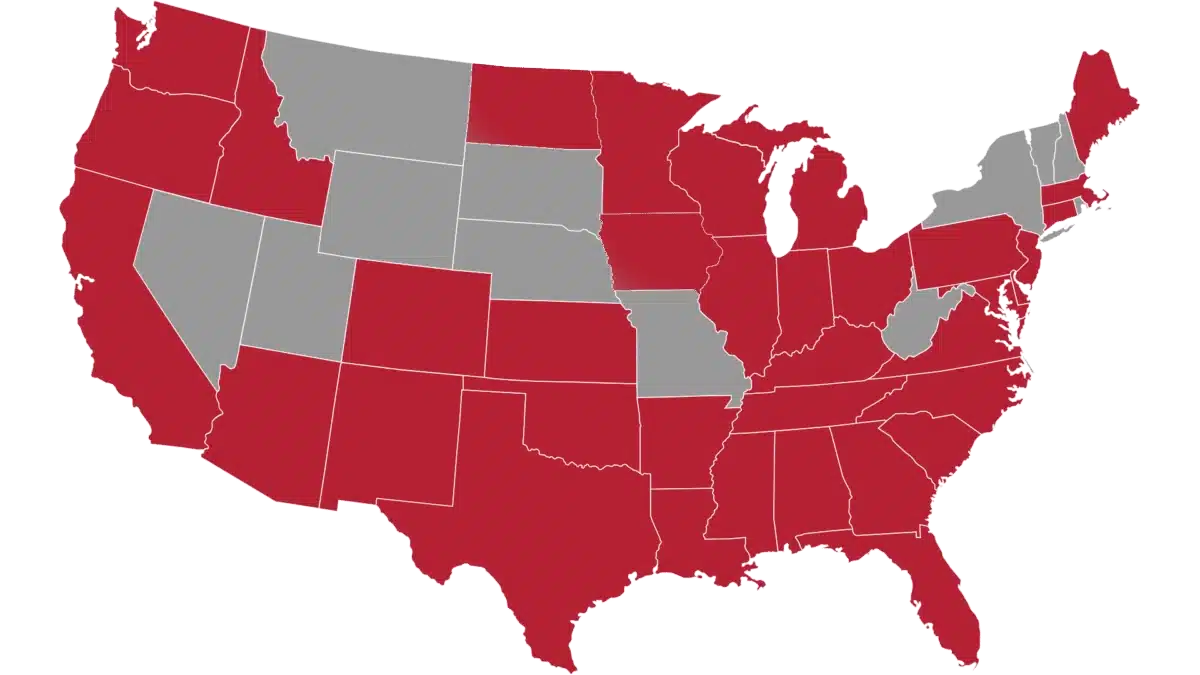

Idaho MBL-2081699966

- Illinois Lic# MB.6761526

- Indiana Lic# 57154

- Iowa MBL-2081699966

Kansas MC.0026115

- Kentucky Lic# MC730506

- Lousiana Lic#1699966

Maine 1699966

- Maryland Lic# 1699966

- Massachusetts Mortgage Broker Lic# MB1699966

- Michigan Lic# FL0022877

- Minnesota MN-MO-1699966

Mississippi 1699966

- New Jersey Lic# 1699966

- North Carolina Lic# L-196983

- Ohio Lic# RM.804353.000

- Oklahoma Lic# ML014576

- Oregon Lic# ML-5756

- Pennsylvania Lic# 77546

- South Carolina-BFI Lic# MLS – 1699966

- Tennessee Lic# 212458

- Texas Lic# 1699966

- Virginia Lic# MC-6867

- Washington Lic# CL-1699966

- Wisconsin Lic# 1699966BA

- Wisconsin Lic# 1699966BR